Amazon’s Case for Offering Free Checking Accounts

Why would Amazon offer a checking account, and who would open it?

The speculation around Amazon’s potential entrance into banking has only heightened, thanks to the recent reports of Amazon being in talks with big banks like JPMorgan Chase and Capital One. While it’s unlikely that Amazon actually plans to become a bank itself, these types of partnerships further reveal that getting in on the banking action is moving up on its “take over the world” to-do list.

According to the Wall Street Journal’s report, the future checking-account-like product built by Amazon would appeal to younger customers and people without bank accounts.

But with millions of customers who do everything from shopping on Amazon, to streaming its videos, to depending on its digital assistant Alexa, they have already built an enormous amount of trust, and many believe that trust could transfer very easily to handling of money too. In fact, U.S. and U.K. consumers already ranked Amazon nearly as high as banks for trust with their money, according to a survey from Bain & Company.

“They’re going after Amazon Prime customers who will not only bank with them, but give Amazon the keys to their houses,” said Ron Shevlin, Director of Research at Cornerstone Advisors.

Interest higher on fee account than free account.

In a recent study from Cornerstone Advisors, consumers are asked about their interest in a checking account offered by Amazon. The results provide meaningful encouragement for banks to not just feel threatened by Amazon’s involvement in banking—but to instead be inspired by their pay-to-save subscription business model that so many people are attracted to.

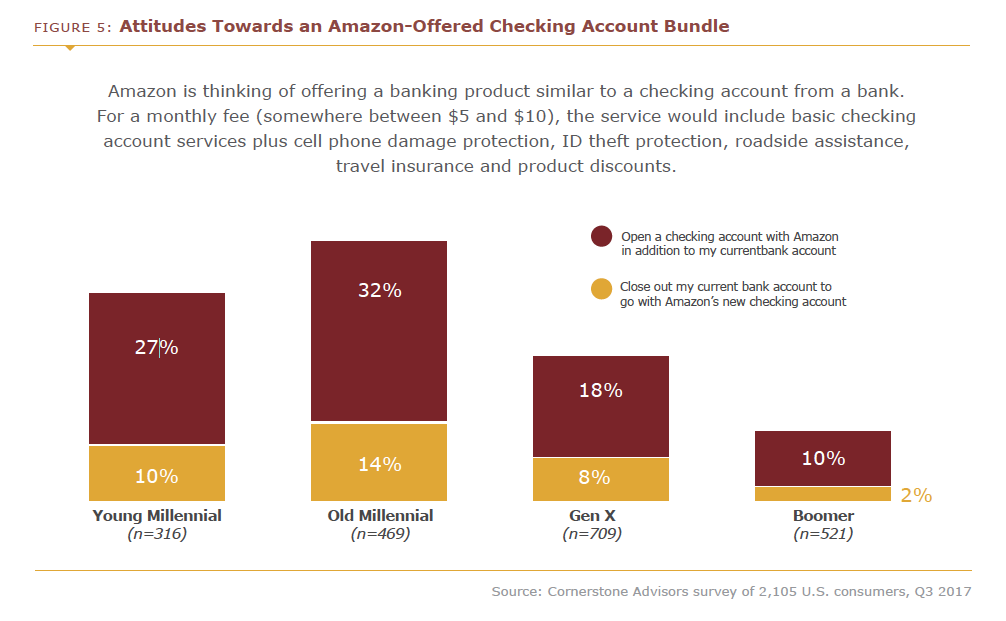

In the survey, nearly half of 30-something millennials said they would pay $5-10 a month for an Amazon checking account, including cell phone protection, ID theft protection, roadside assistance, travel insurance, and product discounts.

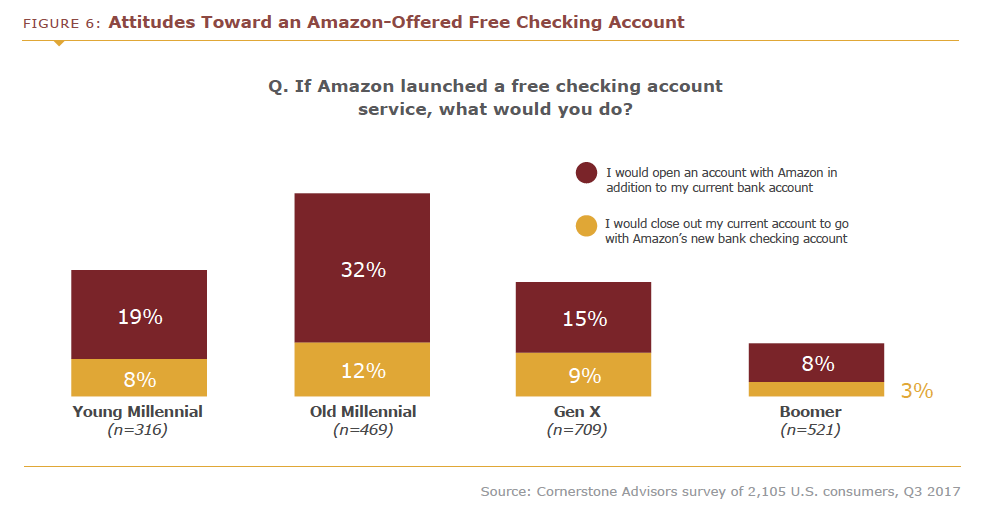

When asked about a free checking account from Amazon without bundled services, interest is lower among all age groups (millennials, Gen Xers and boomers).

“This is music to Amazon’s ears,” said Shevlin. “Why would they want to offer a free checking account when they can bundle the services of various providers on their platform—merchants and financial services providers—and charge a fee for it. A fee that consumers are willing to pay for.”

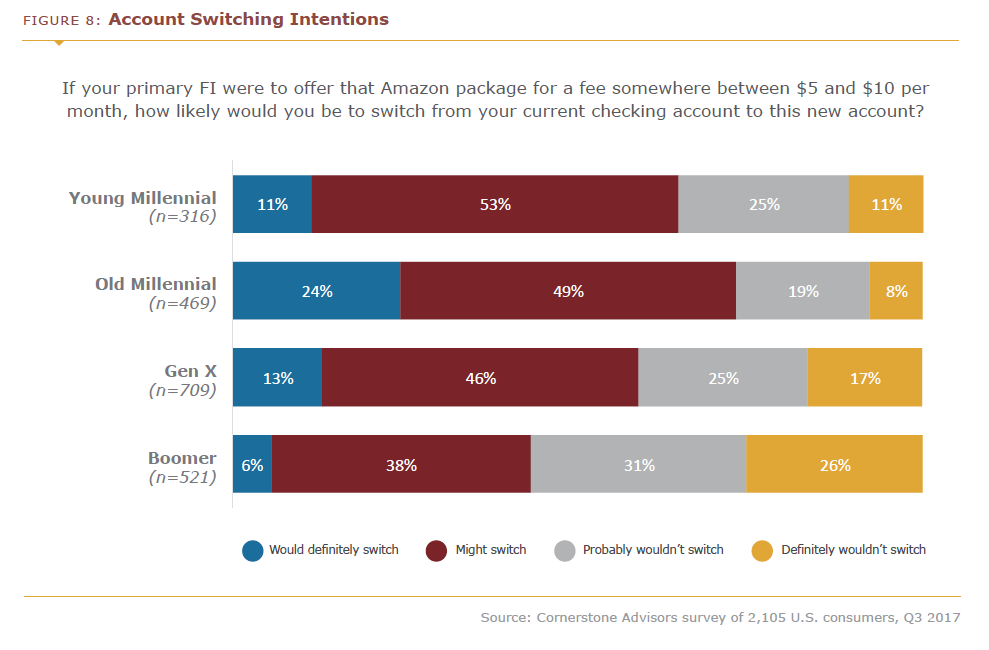

When asked about the hypothetical Amazon account stated above, 73% of 30-somethings say they would definitely switch or would consider switching accounts if their primary financial institution offered a checking account with those valuable services. Sixty-four percent of 20-somethings said the same.

Research about this hypothetical Amazon checking account serves us well to understand what consumers are interested in purchasing as a checking account. But if Amazon is not actually trying to become a bank, what’s there to worry about?

Why Amazon would partner with banks.

One major reason Amazon is seeking these partnerships could be the amount of money saved on processing fees from customers shopping on Amazon—which according to Bain & Company’s calculations, could be more than $250 million every year.

Chase partnered with Starbucks in 2016 to feature their new Chase Pay service inside of the Starbucks app. As part of this deal, Chase was able to win the credit card processing business from Square. And it can be assumed that Starbucks got a win by paying lower processing fees. Could Chase be making Amazon the same offer if they’re given a prominent position inside of Amazon Pay and/or AmazonChecking?

Another motivation for partnering with a bank like Chase.

This opportunity could allow Amazon and Chase to pull their superpowers together to continue to invent new ways to serve customers, such as special banking benefits for being Amazon Prime customers or enhanced technology for banking customers.

“A popular answer is that it wants the data, and that makes Amazon a threat to banks,” said Shevlin. “That’s misguided thinking. Amazon has zero interest in displacing banks, or cutting banks out of the consumer equation.”

Shevlin says that banks are actually best represented as an opportunity to be Amazon’s customers, not partners or competitors. Amazon is a platform-based business that sells products from as many providers as it can in order to attract more customers. Rather than being limited to Chase, Amazon would want all the right types of banking providers. It would also want to be a matchmaker to the right consumers.

“By offering checking accounts on its platform, Amazon is establishing opportunities to provide marketing and technology services to banks that could earn in billions of dollars in revenue,” said Shevlin.

In the end, Chase isn’t going to be Amazon, and Amazon isn’t going to be Chase. But when two of the most dominant players in their industries pair up, the banking industry definitely takes notice and keeps a careful watch.

By Dave DeFazio

Originally posted on ABABankMarketing.com

Dave DeFazio is a partner at StrategyCorps and has spoken at conferences nationwide about innovations in retail banking, mobile banking, customer engagement and customer profitability. Learn more about Dave and his presentation events here.